Payroll withholding calculator

250 minus 200 50. Estimate your federal income tax withholding.

Federal Income Tax Fit Payroll Tax Calculation Youtube

The state tax year is also 12 months but it differs from state to state.

. All Services Backed by Tax Guarantee. Discover ADP Payroll Benefits Insurance Time Talent HR More. How It Works.

The information you give your employer on Form W4. Some states follow the federal tax. Instead you fill out Steps 2 3 and 4.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Use this calculator to help you determine the impact of changing your payroll deductions. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. How to calculate annual income. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

2022 Federal income tax withholding calculation. Ad Process Payroll Faster Easier With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

You can enter your current payroll information and deductions and. All Services Backed by Tax Guarantee. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and. Ad Compare This Years Top 5 Free Payroll Software. IRS tax forms.

Kentucky Revised Statute Chapter 141 requires employers to withhold income tax for both residents and nonresidents employees unless exempted by law. Ad Payroll So Easy You Can Set It Up Run It Yourself. Subtract 12900 for Married otherwise.

For help with your withholding you may use the Tax Withholding Estimator. 2020 Federal income tax withholding calculation. Ad Compare This Years Top 5 Free Payroll Software.

Subtract 12900 for Married otherwise. See how your refund take-home pay or tax due are affected by withholding amount. Get Started With ADP Payroll.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Federal Salary Paycheck Calculator. Free Federal and State Paycheck Withholding Calculator.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Free Unbiased Reviews Top Picks. For example if an employee earns 1500.

You can use the Tax Withholding. Free Unbiased Reviews Top Picks. That result is the tax withholding amount.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. 250 and subtract the refund adjust amount from that. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Computes federal and state tax withholding for. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

Get Started With ADP Payroll. Use this tool to. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Then look at your last paychecks tax withholding amount eg. Thats where our paycheck calculator comes in.

How To Calculate Federal Income Tax

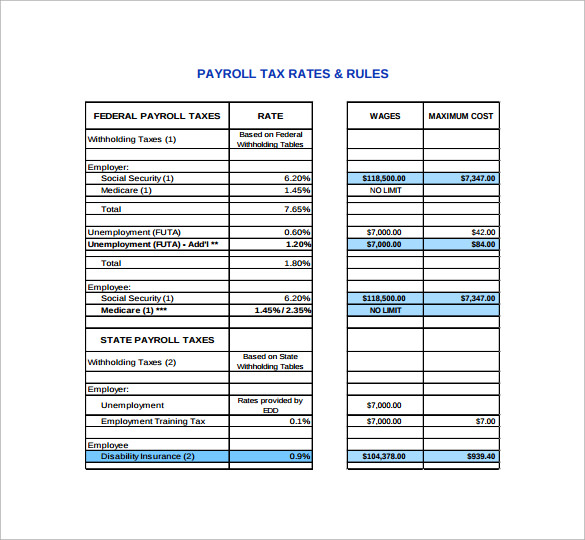

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

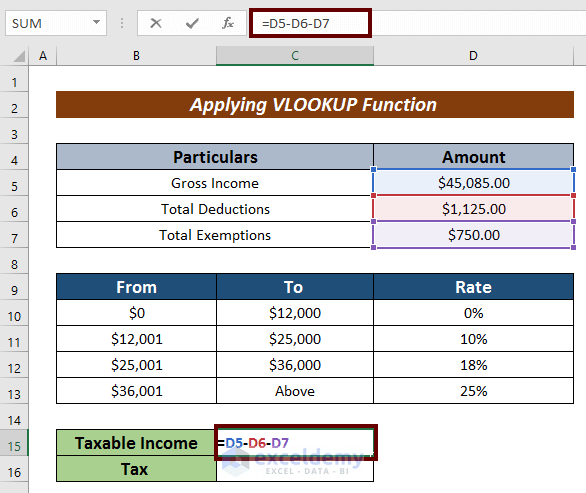

Excel Formula Income Tax Bracket Calculation Exceljet

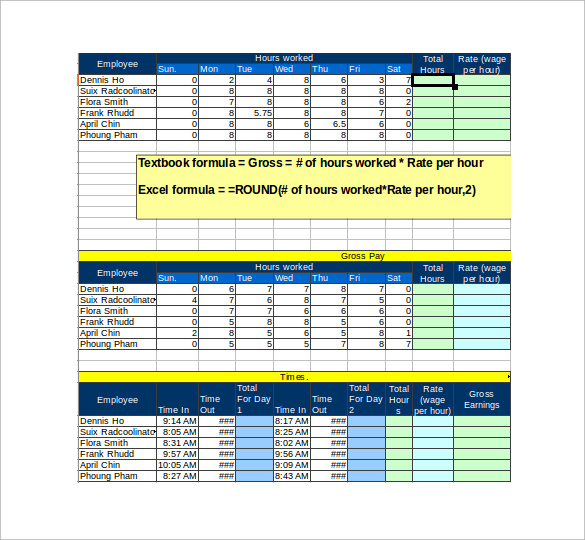

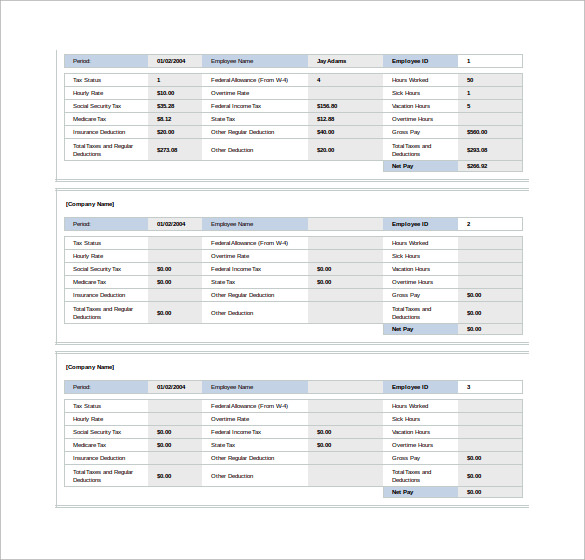

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Calculation Of Federal Employment Taxes Payroll Services

Paycheck Calculator Take Home Pay Calculator

How To Calculate Income Tax In Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Federal Withholding Tax Youtube